Boost App Malaysia

Description of Boost App Malaysia

Boost is a fintech application available for Android that offers a variety of services for users in Malaysia. The app, often referred to simply as Boost, provides a platform for cashless payments, bill payments, and rewards through its BoostUP Loyalty Rewards program. Users can easily download Boost from their preferred sources to access its features.

The app simplifies the payment process, allowing users to make purchases without the need for cash or physical cards. By scanning QR codes at participating merchants, users can complete transactions swiftly and securely. This feature is particularly useful for individuals who may not always have cash on hand, as it eliminates the need to locate an ATM or carry a bulky wallet.

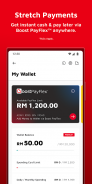

Boost also caters to users who require additional financial management tools. The Boost PayFlex feature enables users to shop or pay bills immediately and defer payment to a later date. This buy now, pay later option is available for various transactions, allowing users to select flexible payment terms that suit their financial situation. Users can manage their spending more effectively by leveraging this feature.

In addition to payment flexibility, Boost provides a comprehensive bill payment service. Users can settle a range of bills—including postpaid mobile, internet, electricity, and water—directly through the app. This service includes features such as AutoBills, which allows users to set up automatic recurring payments, and MultiBills for paying multiple bills at once. The ViewBills feature helps users keep track of their payment history and balances, making it easier to manage finances.

Boost also emphasizes user engagement through its loyalty program. The BoostUP Loyalty Rewards program rewards users with Boost Stars for their spending. The more users transact with the app, the more Stars they accumulate, which can be redeemed for various rewards. This program encourages continued use of the app and offers users tangible benefits for their loyalty.

For those in search of insurance options, Boost provides microinsurance plans that are designed to be accessible and affordable. These plans, underwritten by Great Eastern, include car insurance through the CarProtect plan, which helps users insure their vehicles against unforeseen incidents. This feature enhances the app's utility by providing additional financial protection for users.

Security is a critical aspect of any fintech application, and Boost takes this seriously. The app incorporates various security measures to protect users' personal and financial information, ensuring a safe environment for transactions. Users can feel confident that their data is safeguarded while using the app.

Navigating the Boost app is straightforward, thanks to its user-friendly interface. The design focuses on enhancing the user experience, making it easy for individuals to access different features without confusion. Whether users are looking to make a quick payment, manage their bills, or explore insurance options, the app provides a seamless experience.

Moreover, the app supports multiple telco users, including Digi, Celcom, Hotlink, U Mobile, and redONE. This inclusivity allows a broader range of users to benefit from the app's services, ensuring that more individuals can enjoy the convenience of cashless transactions.

Boost also offers a convenient top-up service for prepaid mobile credit. Users can quickly add credit to their accounts without the need for physical store visits or cumbersome PINs. This feature is particularly appealing for those who frequently find themselves in need of additional prepaid credit.

As users engage with the app, they can also take advantage of various promotional offers and discounts available through Boost’s partnerships with merchants. These promotions often provide users with additional savings, enhancing the overall value of using the app.

The app is designed to cater to a diverse audience, making it suitable for various financial needs. Whether it's for everyday purchases, managing bills, or exploring insurance options, Boost stands out as a versatile tool for enhancing financial management.

By emphasizing ease of use, flexibility, and a range of services, Boost positions itself as a valuable resource for individuals looking to simplify their financial transactions. Its focus on cashless payments and loyalty rewards further enhances its appeal among users.

For more information about Boost and its features, visit https://www.myboost.co, or follow them on social media platforms like Facebook and Instagram.